With the sun shining today all thoughts of #DorisDay, which hit the UK yesterday, are long gone. We woke up to a few pieces of guttering in the garden, but thankfully no major damage. With my husband supporting us all our savings are pretty limited at the moment, which is something I can’t help but worry about.

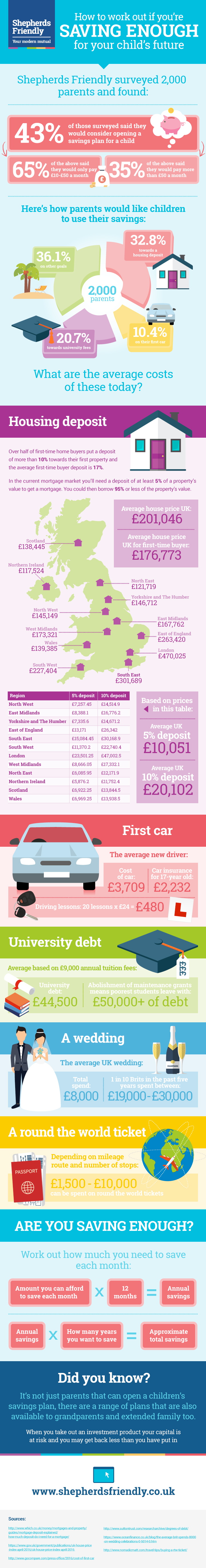

I heard a story on the news this morning that said if we saved all the money given to our children up to the age of 21 they would have enough to buy a house! Now I’m not sure if my children would be happy to miss out on birthday money and pocket money but it did get me thinking about what we are doing. Are you saving enough for your child? Today I’m sharing an infographic all about this.

You can see it contains the average price for many saving goals, as well as a section on how to work out how much you’d need to save each month over how many years in order to reach your goal. To be honest I find it a little scary but by starting to save I hope we will be able to help our children, either with the costs of going to University or buying their first house. You can find out more about about saving for your child, for example with a Junior ISA, here.

Disclosure – this is a collaborative post.

2 Comments

ERFmama

February 26, 2017 at 2:30 amWe didn’t feel much of the storm here. I didn’t actually know it had a name until my husband wanted me to check the back yard fence! hehe

Saving accounts for the kids is def. something I want to set up. As of this minute, it’s not something we have done. They each have a piggy bank that they save in, and then they can spend from there. 🙂

Cecilia

February 26, 2017 at 12:21 pmThis is really interesting! I didn’t think about that that’s definitely something I will think about when I get my first one 🙂 Thanks for the tip and infographic!